12detsad.ru

Prices

What Cards Are Worth The Most Money

What Pokémon Cards Were Worth The Most Money In · #10 - University Magikarp: $78, · #9 - Gold Star Umbreon: $78, · #8 - No. · #7 - No. · #6 - Neo. Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases . In my experience, as a buyer and seller of cards of all sports and all eras, baseball commands the highest prices overall. Individual cards of a. Forced to sell my baseball cards when I was broke, I missed out on a lot of money — but learned some valuable lessons. In my experience, as a buyer and seller of cards of all sports and all eras, baseball commands the highest prices overall. Individual cards of a. Out of all the shiny variants, Espeon is the most valuable because it was distributed by the Pokémon Players Club and given only to people who met certain. The Honus Wagner T The Jumbo Wagner is so valuable that even low-graded cards sell for millions. In , this card sold for a whopping $ million. What Magic Cards Are Worth Money? The simplest answer to this question is that cards that are not only desired but also rare enough to warrant a higher price. Collectible cards have been valued in the tens of thousands of dollars. The most expensive baseball card, a Honus Wagner card from , sold for $ million. What Pokémon Cards Were Worth The Most Money In · #10 - University Magikarp: $78, · #9 - Gold Star Umbreon: $78, · #8 - No. · #7 - No. · #6 - Neo. Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases . In my experience, as a buyer and seller of cards of all sports and all eras, baseball commands the highest prices overall. Individual cards of a. Forced to sell my baseball cards when I was broke, I missed out on a lot of money — but learned some valuable lessons. In my experience, as a buyer and seller of cards of all sports and all eras, baseball commands the highest prices overall. Individual cards of a. Out of all the shiny variants, Espeon is the most valuable because it was distributed by the Pokémon Players Club and given only to people who met certain. The Honus Wagner T The Jumbo Wagner is so valuable that even low-graded cards sell for millions. In , this card sold for a whopping $ million. What Magic Cards Are Worth Money? The simplest answer to this question is that cards that are not only desired but also rare enough to warrant a higher price. Collectible cards have been valued in the tens of thousands of dollars. The most expensive baseball card, a Honus Wagner card from , sold for $ million.

It's so easy to scan my trading cards and know what they are worth. Ludex is the Fastest and Most Reliable Sports and Trading Card Scanner on the Market! Sometimes, it's almost a defiant rebuttal, "Well, then I'll get my cards graded and they'll be worth more!" Truth is, the answer isn't usually the one that most. 15, points is worth $ This earn on spend gets you to your new GM vehicle faster than most cash back credit cards with a single level of earnings. Do you remember that time when your baseball cards were worth money? Or at Fleer Baseball Cards – 25 Most Valuable PLUS Bonus Listings – Wax. From Steph to Mickey Mantle to the up-and-comers, here's how to find undervalued sports cards and turn your hobby into an investment. Top cards include the Topps Mickey Mantle, Honus Wagner T, and Mike Trout Bowman Chrome Superfractor. 2. Why are rookie sports cards valuable? most helpful to the widest variety of readers. Learn More. Are Cash-Back Credit Cards Worth It? Cash-back cards generally fall into one of three categories. What are your trading cards worth? PSAcard Updated regularly by hobby experts, here you will find prices for the most active cards in the marketplace. CardMavin is a price guide for your cards look up how much your cards are worth. Get real market values. What Magic Cards Are Worth Money? The simplest answer to this question is that cards that are not only desired but also rare enough to warrant a higher price. Discounting the Hyper rare Charizard GX(which is expensive because Charizard), most expensive cards are the good ones. Take a look at Cynthia. The world record sale for valuable Michael Jordan cards, and the only basketball card to sell for more than $2M, this is the crown jewel of Jordan cards. valuable cards. Investing in modern rookies: Investing in the rookie cards of up-and-coming athletes can be a potentially profitable. valuable cards. Investing in modern rookies: Investing in the rookie cards of up-and-coming athletes can be a potentially profitable. One of the most popular signatures is that of Mike Trout. On opening day of the baseball season, Topps released Mike Trout signature. 1. American Express Centurion Card. The American Express Centurion Card is the most exclusive credit card in the world and is commonly known as the “Amex Black. 8 1st Edition Neo Genesis Lugia ($,) It's rare for a card released in the West to sell for crazy money unless they happen to be part of the base set. Finally, most states have programs that allow you to recoup unused funds from expired gift cards under unclaimed property laws. Buy Gift Cards with Rewards. One of the most popular signatures is that of Mike Trout. On opening day of the baseball season, Topps released Mike Trout signature. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards.

How Much Can I Overdraft Bank Of America Atm

How do I submit a claim for an incorrect ATM deposit or withdrawal? If your card was issued by Bank of America and you received the incorrect amount of cash or. How Do Overdrafts Happen? · write a check · withdraw money from an ATM · use your debit card to make a purchase · make an automatic bill payment or other electronic. You'll pay a $35 Overdraft Item fee for the ATM withdrawal unless you deposit available funds to cover your overdraft by the end of the business day. Good News! We do not charge an Overdraft Fee if your account is overdrawn by $50 or less at the close of the Business Day. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account balance by more. Funds will be added to your account for the exact dollar amount of the overdraft each night up to a maximum of $ You don't have to remember to make a. We offer two overdraft setting options for how you want us to process your other transactions. Overdraft settings and fees. Option 1: Standard - This setting. If your Available Balance at the end of the business day is overdrawn by $ or less, an Overdraft Paid Fee will not be charged. U.S. Bank limits the number. EDIT: To address the question - yes, probably there's a limit. You'll have to contact the bank and ask them about it. After all, the bank is. How do I submit a claim for an incorrect ATM deposit or withdrawal? If your card was issued by Bank of America and you received the incorrect amount of cash or. How Do Overdrafts Happen? · write a check · withdraw money from an ATM · use your debit card to make a purchase · make an automatic bill payment or other electronic. You'll pay a $35 Overdraft Item fee for the ATM withdrawal unless you deposit available funds to cover your overdraft by the end of the business day. Good News! We do not charge an Overdraft Fee if your account is overdrawn by $50 or less at the close of the Business Day. We charge a $34 Overdraft Fee per transaction during our nightly processing beginning with the first transaction that overdraws your account balance by more. Funds will be added to your account for the exact dollar amount of the overdraft each night up to a maximum of $ You don't have to remember to make a. We offer two overdraft setting options for how you want us to process your other transactions. Overdraft settings and fees. Option 1: Standard - This setting. If your Available Balance at the end of the business day is overdrawn by $ or less, an Overdraft Paid Fee will not be charged. U.S. Bank limits the number. EDIT: To address the question - yes, probably there's a limit. You'll have to contact the bank and ask them about it. After all, the bank is.

However, if the account had sufficient available funds at the time the debit card transaction was authorized, no overdraft fee will be charged. You may choose. Banks typically charge a NSF fee for each transaction, and these fees too can be costly as they can have ripple effects similar to overdraft fees. It is your. Small Overdraft Waiver: Any transactions that create an end of day Available Balance that is overdrawn by $ or less will not be assessed an OD or NSF return. What is overdraft protection? · How can my account be overdrawn when I just made a deposit? · I received notice from my bank that it will no longer authorize. You can withdraw up to $ from a BoA ATM on a daily basis. Overdraft protection does not change that limit. Schedule of Fees · Non-Sufficient Funds Item Fee** (NSF): $ · Overdraft** Fee Each Transaction: $ · A $ Overdraft Fee will be assessed any statement. Please note your $ Overdraft Privilege will not be reflected in your balance provided by a teller, at the ATM or through online banking or telephone. If this happens, you won't be charged a bank overdraft fee, but the merchant or third party could charge you a fee. ATM cutoff time. • Mobile Check. For accounts with Extended Coverage, the Overdraft Privilege Limit is included in the available balance for authorizing ATM and everyday debit card transactions. If you choose to opt out, we will not authorize and pay overdraft items for ATM and everyday debit card transactions, and your transactions will be declined. No more than 2 Overdraft Item fees are charged per day. Please refer to the Personal Schedule of Fees for more details. How much does a safe deposit box cost? Plus any fee charged by the ATM's operator. Preferred Rewards Platinum using a Bank of America debit or ATM card will not be charged the non-Bank of America ATM. We limit daily overdraft charges to 3 overdraft fees per day per account. How TD Overdraft Relief helps:If you overdraw your available account balance and your. We will limit to 5 the number of Overdraft Fees charged on any one business day, up to a total of $ Once you have overdrawn your account, you must bring it. Our overdraft fee for Business and Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or. When Overdraft Privilege is used, an Overdraft Fee will be imposed for overdrafts created by checks, ACH, point-of-sale, ATM transactions, in-person withdrawals. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. You can have access to up to $2, to cover checking account transactions*. Since you only pay interest if the line of credit is used, you can save money on. Doesn't apply to debit card transactions, electronic debits, and checks deposited through Mobile. Check Deposit, Bank of America ATM, or Remote Deposit Online. Unless your account is covered under the MoneyPass® Network of ATMs, there is a $ fee for a denied ATM transaction at a machine we do not own.

Are You Ready To Buy Your First Home

1. Get credit ready. · 2. Know what you can afford. · 3. Start saving for your down payment. · 4. Find a lender you can trust. · 5. Explore your mortgage options. Home buying process can be daunting, stressful and brutal specially in this highly competitive market where you only get to see a house once or. How to know when you're ready to buy a house · 1. You have dependable income · 2. Your debt-to-income ratio is low · 3. You have a good credit score · 4. You have. Buying a home is one of life's most major decisions. Many first time home buyers are ill prepared and are forced to exit their first home in search of greener. 1. Why do I want a house? A home will likely be the largest purchase you'll have ever made, so it's crucial to evaluate your motives. · 2. How long will I be. It's hard to predict the future, but if you can't afford to buy a home that will accommodate your new dog, new significant other, or new baby, and any of these. Buying a home for the first time can seem daunting. Learn the buying process and what to watch out for to be a successful first-time homebuyer. While it is not always required that you put 20% down, this rate is a good number to aim for to limit the costs of your loan. Still, there are many down payment. There's a lot to consider about homeownership. Are you a renter with a desire to purchase your first home? An existing homeowner considering buying a vacation. 1. Get credit ready. · 2. Know what you can afford. · 3. Start saving for your down payment. · 4. Find a lender you can trust. · 5. Explore your mortgage options. Home buying process can be daunting, stressful and brutal specially in this highly competitive market where you only get to see a house once or. How to know when you're ready to buy a house · 1. You have dependable income · 2. Your debt-to-income ratio is low · 3. You have a good credit score · 4. You have. Buying a home is one of life's most major decisions. Many first time home buyers are ill prepared and are forced to exit their first home in search of greener. 1. Why do I want a house? A home will likely be the largest purchase you'll have ever made, so it's crucial to evaluate your motives. · 2. How long will I be. It's hard to predict the future, but if you can't afford to buy a home that will accommodate your new dog, new significant other, or new baby, and any of these. Buying a home for the first time can seem daunting. Learn the buying process and what to watch out for to be a successful first-time homebuyer. While it is not always required that you put 20% down, this rate is a good number to aim for to limit the costs of your loan. Still, there are many down payment. There's a lot to consider about homeownership. Are you a renter with a desire to purchase your first home? An existing homeowner considering buying a vacation.

Do you really want to buy a property that contains your dream house if that Be prepared for the cost to be higher than you think, especially once. A stress-free home purchase is all about being prepared. You can get ahead of the game by gathering your financial paperwork: all bank account statements, Before you leap into all of the benefits of homeownership, you should get prepared first Owning your home means you can paint the walls with your. The key is to review your financial situation before you check out open houses. Use our affordability calculator to see what kind of monthly mortgage payment. Are you ready to buy a house? Take our quiz to learn how factors like credit score and savings can help you determine if you are ready. Before you fill out any paperwork, start saving up for your down payment. Most traditional home loans require 20% of the home's purchase price up front, while. Listing agents work for the seller of the home. It's worth considering finding a buyer's agent to represent your needs instead of using a realtor who is selling. Buying your first home can feel daunting. But before diving in, the first thing you should do is analyze your financial picture to figure out if buying a home. Figure out how much house you can afford and want to afford. Lenders look for a total debt load of no more than 43% of your gross monthly income (called the. One Month Out · Provide your mortgage lender with all required documentation. Didn't they already do this when pre-approving you? · Schedule your home inspection. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Realtors can educate you on the many financial complexities that come with buying a home, and they'll provide honest advice during your search. There are. Are You Ready to Buy a House? · Understand Your Debt-to-Income Ratio First · What Mortgage Lenders Want · Can You Afford the Down Payment? · The Housing Market · The. Qualifying to Buy Your First Home Buying your first home may seem overwhelming, but with the help of a real estate agent, it can go smoothly. It takes a long. You'll then need to start the steps to buying a house, including getting pre-approved, finding an agent, making an offer, and closing. When you want to buy a home, there are three aspects to concern yourself with. (1) Is it a good investment? (2) Are your finances in order? and. Buying a Home for the First Time Has Amazing Benefits · 1. You're About to Save Money · 2. Your Investment will Appreciate · 3. You Can Customize and Upgrade to. Option 1: Sell first, then buy. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their. Once you know what you qualify for, save time and energy by narrowing your search to homes that fit your financial criteria. Try to preview properties online. 7. You don't necessarily need a 20% down payment. · Low down payment loans with Mortgage Insurance · Piggy Back loans: Two loans taken out for the purchase, the.

S&P Technology Stock

View the full S&P Information Technology Sector Index (SPXX) index overview including the latest stock market news, data and trading information. Stock® Index (“S&P ®”). The eleven Select Sector Indexes (each a “Select Sector Index”) upon which the Select Sector SPDR Funds are based together. S&P Information Technology Index quotes and charts, tech stocks, new highs & lows, and number of stocks above their moving averages. iShares S&P Information Technology Sector UCITS ETF USD (Acc) | IUIT ; Apple Inc, Technology, ; NVIDIA Corp, Technology, ; Microsoft Corp. Technology Equities ETFs offer exposure to stocks within the technology sector. S&P Equal Weight Technology ETF, $3,,, %, ,, $ Holdings ; %, TEL, TE CONNECTIVITY LTD ; %, V · VISA INC-CLASS A SHARES ; %, ORCL, ORACLE CORP ; %, CDW, CDW CORP/DE. The S&P Information Technology live stock price is 4, What Is the S&P Information Technology Ticker Symbol? SPLRCT is the ticker symbol of the S&P. S&P Information Technology Sector Index advanced index charts by MarketWatch stock quotes reflect trades reported through Nasdaq only. Intraday. The S&P North American Technology Sector Index provides investors with a benchmark that represents U.S. securities classified under the GICS® information. View the full S&P Information Technology Sector Index (SPXX) index overview including the latest stock market news, data and trading information. Stock® Index (“S&P ®”). The eleven Select Sector Indexes (each a “Select Sector Index”) upon which the Select Sector SPDR Funds are based together. S&P Information Technology Index quotes and charts, tech stocks, new highs & lows, and number of stocks above their moving averages. iShares S&P Information Technology Sector UCITS ETF USD (Acc) | IUIT ; Apple Inc, Technology, ; NVIDIA Corp, Technology, ; Microsoft Corp. Technology Equities ETFs offer exposure to stocks within the technology sector. S&P Equal Weight Technology ETF, $3,,, %, ,, $ Holdings ; %, TEL, TE CONNECTIVITY LTD ; %, V · VISA INC-CLASS A SHARES ; %, ORCL, ORACLE CORP ; %, CDW, CDW CORP/DE. The S&P Information Technology live stock price is 4, What Is the S&P Information Technology Ticker Symbol? SPLRCT is the ticker symbol of the S&P. S&P Information Technology Sector Index advanced index charts by MarketWatch stock quotes reflect trades reported through Nasdaq only. Intraday. The S&P North American Technology Sector Index provides investors with a benchmark that represents U.S. securities classified under the GICS® information.

The estimated P/E Ratio for S&P Information Technology Sector is , calculated on 23 August P/E Ratio is calculated on the XLK Etf, whose. Equity Risk: The value of equities and equity-related securities can be affected by daily stock market movements. Other influential factors include political. Stocks primarily covering products developed by internet software and service companies, IT consulting services, semiconductor equipment, computers and. Markets. Global Stocks Reach Record High as Powell Talks Rate Cuts. updated Aug 23, Technology. Loeb's Third Point Adds Apple Shares, Still Can't Beat S&P. The Yahoo Finance guide to the US presidential race. SNP - Delayed Quote • USD. S&P Information Technology (^SP). Follow. 4, + (+%). Holdings ; MSFT, MICROSOFT CORP, Information Technology ; AVGO, BROADCOM INC, Information Technology ; CRM, SALESFORCE INC, Information Technology ; ADBE, ADOBE INC. US - S&P - Information Technology Sector - Forward PE Ratio · Zoom · 6m · YTD · 1y · 3y · 5y · All. Yahoo Finance's Technology performance dashboard help you quickly analyze & examine stock performance across the Technology sector using dozens of metrics. A few also buy medical-device and biotechnology stocks and some concentrate on a single technology industry. Invesco S&P ® Equal Weight Tech ETF. RSPT |. ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage. A Complete S&P Information Technology Sector Index overview by Barron's. View stock market news, stock market data and trading information. Sort S5INFT stock components by various financial metrics and data such as performance, dividends, income statement and balance sheet. Holdings ; %, V · VISA INC-CLASS A SHARES ; %, PG, PROCTER & GAMBLE CO/THE ; %, JNJ, JOHNSON & JOHNSON ; %, COST, COSTCO WHOLESALE CORP. Effective at the close of markets on July 14, , the Fund will effect a “3 for 1” forward split of its issued and outstanding shares. Please see the. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the information technology sector. · Passively managed. Holdings ; AAPL, APPLE INC, Information Technology ; NVDA, NVIDIA CORP, Information Technology ; MSFT, MICROSOFT CORP, Information Technology ; AVGO, BROADCOM INC. Top 5 holdings ; Microsoft Corp MSFT:NSQ, +% ; Apple Inc AAPL:NSQ, +% ; NVIDIA Corp NVDA:NSQ, +% ; Broadcom Inc AVGO:NSQ, +% ; Salesforce Inc. S&P/ASX Information Technology (Sector): Live performance data, current price, company overview and company list. Find information for more ASX stock. S&P Information Technology (SPLRCT) ; 4, (%). Delayed Data ; Day's Range. 4, 4, 52 wk Range. 2, 4, Recent News. MarketWatch. Dow Jones. Read full story. Technology Okta Stock Is Soaring. S&P/TSX Composite Index, 23,, , %. IPC Indice de.

Bank Deals With Direct Deposit

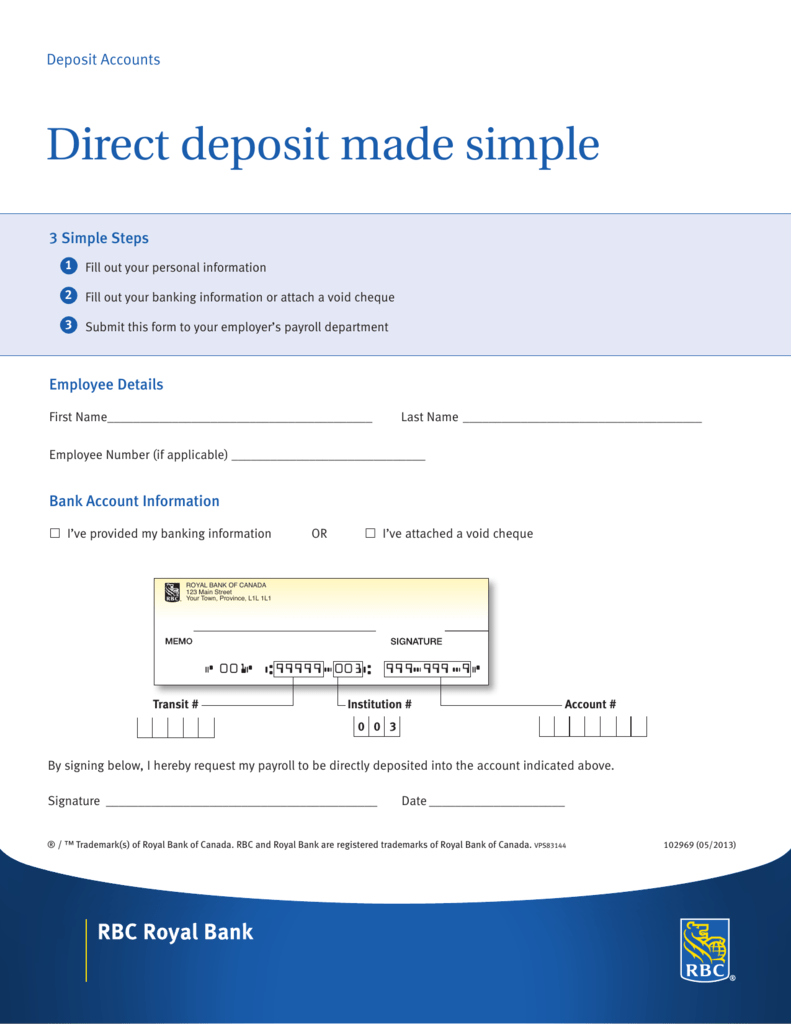

Earn up to a $ cash bonus. Your cash bonus will be awarded within 90 days after completing the qualifying direct deposits. We even offer a pre-filled direct deposit form you can give to your payer. Skip trips to the bank and get paid automatically with direct deposit. NEW. Have $ total in qualifying direct deposits post to the account within 60 days. Earn $ Bonus will be paid on or before days after account opening. 1. All Accounts Include · Banking alerts · Online bill pay · Overdraft protection available · Automatic transfers · Direct deposit · Visa® debit card included. Eliminate trips to the bank by having your pay automatically deposited to your account each payday. Direct deposit is safer and more convenient than receiving a. Direct deposit is a simple, safe, and secure way to get benefits. If you do not have a bank account, the FDIC website offers information to help you open an. Direct deposit is a convenient and reliable way to have funds deposited directly into your RBC account so you can quickly access your money. With salary direct deposit, your money will automatically be deposited into your National Bank account. Find out how. To qualify for the up to $ bonus², you must open a new SoFi Checking and Savings account and receive at least $5, in direct deposits by December 31, Earn up to a $ cash bonus. Your cash bonus will be awarded within 90 days after completing the qualifying direct deposits. We even offer a pre-filled direct deposit form you can give to your payer. Skip trips to the bank and get paid automatically with direct deposit. NEW. Have $ total in qualifying direct deposits post to the account within 60 days. Earn $ Bonus will be paid on or before days after account opening. 1. All Accounts Include · Banking alerts · Online bill pay · Overdraft protection available · Automatic transfers · Direct deposit · Visa® debit card included. Eliminate trips to the bank by having your pay automatically deposited to your account each payday. Direct deposit is safer and more convenient than receiving a. Direct deposit is a simple, safe, and secure way to get benefits. If you do not have a bank account, the FDIC website offers information to help you open an. Direct deposit is a convenient and reliable way to have funds deposited directly into your RBC account so you can quickly access your money. With salary direct deposit, your money will automatically be deposited into your National Bank account. Find out how. To qualify for the up to $ bonus², you must open a new SoFi Checking and Savings account and receive at least $5, in direct deposits by December 31,

Direct deposit is the deposit of electronic funds directly into a bank account. It offers a predictable process for funds transfer. Open any new Associated Bank checking account, in person or online. Have direct deposits totaling $ or more put into your new. Earn $ Bonus will be paid on or before days after account opening. Step 1 Open a TD Complete Checking account. Step 2. Many banks offer early direct deposit only on a specific checking account—but Regions customers can enjoy Early Pay on all checking, savings and money. Open your first Smart Account, then within two months: Set up recurring direct deposits of $ or more per month from your employer, government or pension. The Benefits of Direct Deposit When you enroll in Direct Deposit, your net pay is transferred electronically to your bank account. Direct Deposit is the safer. Get your $ We'll deposit your bonus within 30 days of your account receiving $1, in qualified direct deposits. For more details, check out our terms. It's possible you'll receive part of the cash offer for opening the account, but have to sign up for automatic bill pay, direct deposit, or some other task to. Note that transaction and posting dates can vary and some transactions may take up to three business days to post to your account. Direct deposit is defined. Open your first checking account with qualifying direct deposit and you can get $* Bank better with Visions - and don't pass on this promotion! Get. as a new Chase checking customer, when you open a Chase Total Checking® account and make direct deposits totaling $ or more within 90 days of coupon. Open a FirstView or SmartView checking account. · Make qualifying direct deposits totaling $ within the first 90 days. Does anybody else use take advantage of lots of direct deposit promotions? Is there any reason to maintain US BANK checking/savings accounts. (i) be an EQ Bank customer; and. (ii) set up one or more eligible automated and recurring payroll direct deposits (categorized under the Canadian Payment. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Huntington Bank: Huntington Perks Checking - $ · Truist: Truist One Checking - $ · Citizens Bank: Citizens One Deposit Checking - $ · Chase: Chase Total. Direct deposit is the easy way to have your paycheck, Social Security check or other recurring items deposited automatically. Learn how to set up direct. Signing up for direct deposit is safe and secure. You'll avoid standing in bank lines or dealing with bad weather to cash a check. And you won't need to worry. Find great deals with Capital One Shopping. Get free coupon. Direct direct deposit automatically transfers your pay to your bank account. So you. How can I qualify for a bank account bonus offer? Citibank checking and savings bonus offers typically require a deposit of new-to-the-bank cash, transferred.

Show Me Bank Of America

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/14294023/BoA.1419979441.jpeg)

Sign in and access your BofA Private Bank account. Login and get access to all the account features and benefits online. Get all the help you need and see. Show all. MMA · WNBA · Sportsbook · NCAAF · Tennis · Golf · NASCAR · NCAAB · NCAAW Bank of America has operations in several countries but is primarily US-. Log in to Mobile & Online Banking to access your personal and small business accounts, see balances, transfer funds, pay bills and more. Select Your State. Please tell us where you bank so we can give you accurate rate and fee information for your location. Information for: Alabama. Bank smarter with U.S. Bank and browse personal and consumer banking services including checking and savings accounts, mortgages, home equity loans. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts •View account balances and review. View balances, make transfers, deposit checks with the Bank of America App. We never miss an opportunity to celebrate all business owners. This #BlackBusinessMonth and beyond, join us in celebrating the contributions of Black-owned. Get answers to your questions about Bank of America's products and services. Learn about your account, your routing number and more in our help center. Sign in and access your BofA Private Bank account. Login and get access to all the account features and benefits online. Get all the help you need and see. Show all. MMA · WNBA · Sportsbook · NCAAF · Tennis · Golf · NASCAR · NCAAB · NCAAW Bank of America has operations in several countries but is primarily US-. Log in to Mobile & Online Banking to access your personal and small business accounts, see balances, transfer funds, pay bills and more. Select Your State. Please tell us where you bank so we can give you accurate rate and fee information for your location. Information for: Alabama. Bank smarter with U.S. Bank and browse personal and consumer banking services including checking and savings accounts, mortgages, home equity loans. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts •View account balances and review. View balances, make transfers, deposit checks with the Bank of America App. We never miss an opportunity to celebrate all business owners. This #BlackBusinessMonth and beyond, join us in celebrating the contributions of Black-owned. Get answers to your questions about Bank of America's products and services. Learn about your account, your routing number and more in our help center.

Head of U.S. Economics for Bank of America Securities Michael Gapen expects (Link in bio.) Show more posts from bankofamerica. Related accounts. See. Select Your State. Please tell us where you bank so we can give you accurate rate and fee information for your location. Information for: Alabama. votes, comments. I'm a college student in the US. Basically, I tried to deposite my cash savings and it came up to a decent sum (but. We use the mid-market rate and show fees upfront, so you'll On this website – We've listed routing numbers for some of the biggest banks in the US. Want us to walk you through it? Show me how to pay my bills in Online Banking · Show me how to pay my bills in Mobile Banking · View all Online Banking FAQs. Bank Of America ; Parent company of Saks Fifth Avenue to buy rival Neiman Marcus for $ billion, · Warren Buffett's Benevolence. News ; US consumers keep. Show your current security meter level. Recommend ways to boost your security Contact Us · Help & Support; Browse with Specialist; Accessible Banking. U.S., using the Bank of America Mobile Banking app with Zelle Show me how to send money with Zelle in Mobile BankingShow me how to send. Contact Us. Subscribe to our Newsletter. Subscribe Sign up. By clicking "submit" you agree to receive emails from Bank of America Store and accept our web. It's banking made easier with our Bank of America mobile banking app. Show me how to deposit checks in Mobile banking. Share. FacebookLinkedIn. Bank of America provides people, companies and institutional investors the financial products and services they need to help achieve their financial goals. Discover the many convenient features of Mobile Banking and Online Banking available to Bank of America customers. Call us. Your card or account number will be required. General account information. Report a lost or stolen ATM. Show more. 68 Not for me. %. votes·Final results. Bank of America's Global Corporate and Investment Banking has its U.S. "BofA documents, e-mails show pressure to buy Merrill Lynch". Reuters. Archived. Welcome to Bank of America's financial center location finder. Locate a financial center or ATM near you to open a CD, deposit funds and more. please tell me what you know that may benefit me in resolving this case. me, i never would have done business with Bank of America. If you. U.S. consumer and small business relationships. It is among the Show more jobs like this. Show fewer jobs like this. Stock. BAC. August 26, To bank by phone, call Use these addresses for mailing us deposits. Other correspondence should be mailed to the Customer Service and Support. For the best ways to contact us about specific issues, please select a topic. About Bank of America · Account changes · ATMs · Auto loans.

Below Market Value Mortgages

A Below Market Value (BMV) property is one which is on sale for less than similar properties in the same location. In other words, it is a property which. Note: CLTs typically subsidize the sale price of the property. As a result, the price paid may be significantly less than the market value of the property. Buying property below market value gives you an immediate paper profit. If you sell at market value quickly, you'd make a good return on your investment. So if. Mortgage in which you receive a below-market interest rate for a specified number of years (most often seven or 10 years), and then receive a new interest rate. Shared Appreciation Mortgage (SAM) A mortgage in which a borrower receives a below-market interest rate in return for which a lender (or another investor such. Mortgage in which you receive a below-market interest rate for a specified number of years (most often seven or 10 years), and then receive a new interest rate. The Department of Housing and Urban Development usually price these investment properties below market value! Go to Real Estate Auctions. In. A below market value mortgage is for buying a property sold below its market price. This happens in different situations, like government schemes for first-time. Buying property at below market value is where the seller is offering a deal or special price to a buyer, which is below the usual market valuation or asking. A Below Market Value (BMV) property is one which is on sale for less than similar properties in the same location. In other words, it is a property which. Note: CLTs typically subsidize the sale price of the property. As a result, the price paid may be significantly less than the market value of the property. Buying property below market value gives you an immediate paper profit. If you sell at market value quickly, you'd make a good return on your investment. So if. Mortgage in which you receive a below-market interest rate for a specified number of years (most often seven or 10 years), and then receive a new interest rate. Shared Appreciation Mortgage (SAM) A mortgage in which a borrower receives a below-market interest rate in return for which a lender (or another investor such. Mortgage in which you receive a below-market interest rate for a specified number of years (most often seven or 10 years), and then receive a new interest rate. The Department of Housing and Urban Development usually price these investment properties below market value! Go to Real Estate Auctions. In. A below market value mortgage is for buying a property sold below its market price. This happens in different situations, like government schemes for first-time. Buying property at below market value is where the seller is offering a deal or special price to a buyer, which is below the usual market valuation or asking.

By obtaining below market value finance, investors can secure properties at discounted prices, either due to distressed sales, seller motivations, or market. Not all lenders will loan on Below Market Rate homes. There are some terms in the resale restrictions that prevent lenders from issuing loans to borrowers. It would determine the value of the below-market mortgage and add that to the price. mortgages -- have lost value when compared to prevailing market rates. A mortgage with an interest rate that changes during the life of the loan according to movements in an index rate. Sometimes called AMLs (adjustable mortgage. Shared equity programs preserve affordable homeownership opportunities by allowing borrowers to purchase homes at below-market prices. In exchange, borrowers. Monthly housing costs include mortgage (principal and interest), private mortgage insurance (if applicable), hazard insurance, property taxes, condominium fees. Rate to homebuyers shortly after they apply for the loan. Also known as a TIL. Two-Step Mortgage A mortgage in which the borrower receives a below-market. If you need to act fast to secure a property below market value, a bridging loan may be the solution you need. If you are using a Bridging Loan as a short. Borrowers can purchase homes at below market prices · Borrowers have the opportunity to build equity while being able to purchase an affordable property. Rather, they are defined by how far below CURRENT market value you can buy it. Despite the fall in the overall market, there are techniques that can be used to. A gift of equity refers to when your friend or family member sells you the property at a price below market value. Typically, this occurs when the sales price. My taxes this year are based on a value roughly % of my purchase price, which was market value. The current tax value is right around what my. It's considered a niche mortgage, as many lenders see it as distressed sale when the property valued at 90% or less than the valuator report. While it's not. These requests and communications can involve compliance certifications, requests to refinance a mortgage, remodeling the home, or initiating a property sale. When you apply for a buy-to-let mortgage, the lender will want a deposit based upon the the purchase price not the value of the property. You. Below Market Value Finance is generally bridging finance where the lender uses the value of the property, rather than the purchase price, for the purposes of. Can I Buy Parents House Under Market Value? As long as both parties agree to the sales price then you can sell your home to whomever you like at whatever. Concessionary Purchase/Genuine Bargain Price is where the property is knowingly being purchased by your client below the market value. The purchase can't be. So we were finally approved on a mortgage through the credit union of for a property we are buying at Follow the 8 Steps below to make the home-buying process a little easier! CHFA can help with financing. We offer year, fixed-rate mortgages with below-.

If I Owe 10000 On My Car

Let's say your car is worth $10, but you still owe $12, You might find yourself underwater on your car loan if any of the following scenarios apply to. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed. Dealership Financing vs. Direct Lending. Generally, there are. Example:If your loan balance is $12, and your vehicle's negotiated trade-in value is only $10,, the vehicle would have a negative equity amount of $2, 10, miles per year. Are you upside down on your trade? In other words do you owe more on your vehicle than it is worth? Negative loan equity or being. If the sale proceeds do not pay off the loan's balance, the remaining amount owed is an unsecured debt. Within certain time limits, the creditor can file an. Positive equity occurs when your vehicle is worth more than you owe the lender. For example, if you owe $10, on your vehicle, but your vehicle is worth. Yes you can. It does not affect the value. The dealership will add the remaining balance to the price quote. They will pay the loan off after. If you're considering trading in a car that is not paid off, you're in one of two situations: the car is worth more than the amount you owe on your loan . If the remaining balance of your auto loan is more than the trade-in offer, then you'll still owe money on your car–this is called negative equity. You can pay. Let's say your car is worth $10, but you still owe $12, You might find yourself underwater on your car loan if any of the following scenarios apply to. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed. Dealership Financing vs. Direct Lending. Generally, there are. Example:If your loan balance is $12, and your vehicle's negotiated trade-in value is only $10,, the vehicle would have a negative equity amount of $2, 10, miles per year. Are you upside down on your trade? In other words do you owe more on your vehicle than it is worth? Negative loan equity or being. If the sale proceeds do not pay off the loan's balance, the remaining amount owed is an unsecured debt. Within certain time limits, the creditor can file an. Positive equity occurs when your vehicle is worth more than you owe the lender. For example, if you owe $10, on your vehicle, but your vehicle is worth. Yes you can. It does not affect the value. The dealership will add the remaining balance to the price quote. They will pay the loan off after. If you're considering trading in a car that is not paid off, you're in one of two situations: the car is worth more than the amount you owe on your loan . If the remaining balance of your auto loan is more than the trade-in offer, then you'll still owe money on your car–this is called negative equity. You can pay.

When a dealership offers to pay off the total amount that you owe on your car, even if it's more than what the vehicle's worth, it usually means they're tacking. So, if you owe $9, on your current vehicle, and you receive a $10, offer from the dealer, you'll have an extra $1, to spend on your new vehicle. If you. If you have negative equity on the car (as in it's worth less than what you currently owe), the dealer may still buy the car and pay off the loan, but the. Can You Get Title Loans for Cars Not Paid Off? If you're struggling to make ends meet, the key to getting the cash you need might be using your vehicle as. If your car is worth $10, and you still owe $15, then you don't have $5, equity, you have a negative $5, equity so you'll need. For example, let's say you owe $9, on your car and the dealership offers $10, for the vehicle. loan refers to when the dealership pays off your old loan. the dealership, then you'll have money leftover that will go towards purchasing a new car from the dealer. For example, if you still owe $10, on your car. If the amount you still owe on the vehicle is less than our offer, then you For example, if you still owe $9,, and we offer you $10,, then. If you still owe money on your current ride, you could roll that negative equity onto the loan for your next car. You just want to make sure that the new. If you total a financed car, you are still on the hook for the balance of your loan. Gap insurance can help cover the difference between your car's ACV and. If you need a newer car sooner, you may consider paying off the negative equity all at once out of your own pocket. For example, if you currently owe $15, on. For instance, if you still owe $7, on a car that's worth $5,, the dealer will credit you $5, for the trade-in and add the remaining $2, to the new. You can trade in your car to a dealership if you still owe on it, but it has to be paid off in the process, either with trade equity or out of pocket. You can also sell the car and then take out another loan to cover the remaining amount owed. Can You Trade In an Upside Down Car? Some dealerships allow you to. The very first thing you need to do is find out the accurate amount you still owe on your car. The easiest way to do this is to call your lender and have them. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance. Have you valued your trade-in and discovered that the car is worth less than what still owe on the loan? If so, this means that your car has negative equity. Negative equity is what happens when you owe more on your auto loan than your car is worth. If it's time to get a new vehicle, but there's no equity to use. When your loan gets "rolled over," the dealership will pay off the old loan no matter how much you owe. However, this does not mean that you're no longer. However, if you've only paid off $3, of your loan, you owe $22, – leading to negative equity. Long-Term Financing. Extended loan terms can lead to slower.

How Do I Buy Nft Tokens

These marketplaces can be used to buy an NFT at a fixed price or function as a virtual auction, much like the exchange system for buying and selling. A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain and is used to certify ownership and authenticity. NFTs are often sold through an auction system where you will put in a bid for the NFT. Some sites like OpenSea offer an option to buy the NFT now for a set. NFT pictures is just the early days. NFT can be used to hold any asset. It's already being used. You can store “ ____” of a token in a NFT. Buy NFT Tokens · Before getting started with your NFT collection, you'll need to acquire some items. · Set up your crypto wallet · Setting up your cryptocurrency. NFTs are listed on these platforms and can be accessed by potential buyers. To buy an NFT it is necessary to have an account with cryptocurrencies. Connect your wallet to an NFT marketplace. Once connected, you can start browsing the marketplace's NFT collection and make a purchase. NFTs can represent digital or real-world items like artwork and real estate. "Tokenizing" these real-world tangible assets makes buying, selling, and trading. Via a self-custody crypto wallet like Coinbase Wallet, you can buy, sell, transfer, and hold NFTs just like you'd do those same things with a cryptocurrency. These marketplaces can be used to buy an NFT at a fixed price or function as a virtual auction, much like the exchange system for buying and selling. A non-fungible token (NFT) is a unique digital identifier that is recorded on a blockchain and is used to certify ownership and authenticity. NFTs are often sold through an auction system where you will put in a bid for the NFT. Some sites like OpenSea offer an option to buy the NFT now for a set. NFT pictures is just the early days. NFT can be used to hold any asset. It's already being used. You can store “ ____” of a token in a NFT. Buy NFT Tokens · Before getting started with your NFT collection, you'll need to acquire some items. · Set up your crypto wallet · Setting up your cryptocurrency. NFTs are listed on these platforms and can be accessed by potential buyers. To buy an NFT it is necessary to have an account with cryptocurrencies. Connect your wallet to an NFT marketplace. Once connected, you can start browsing the marketplace's NFT collection and make a purchase. NFTs can represent digital or real-world items like artwork and real estate. "Tokenizing" these real-world tangible assets makes buying, selling, and trading. Via a self-custody crypto wallet like Coinbase Wallet, you can buy, sell, transfer, and hold NFTs just like you'd do those same things with a cryptocurrency.

purchase collectability of tickets through exclusive experiences and digital art. Fan/customer engagement – brands or organizations can issue or sell NFTs. A crypto exchange is an online platform where you can buy and sell different types of cryptocurrencies. To buy NFTs, you need to create an account with your. One of the earliest and most popular applications for NFTs is the Ethereum-based game CryptoKitties, which allows players to buy, sell, and breed digital cats. NFTs, short for Non-Fungible Tokens, are one-of-a-kind digital assets. They use blockchain technology, which is a secure, decentralized digital ledger. The most common ways to buy an NFT are: Purchasing NFTs on secondary NFT marketplaces. For NFT collections that have already dropped and are actively traded. Choosing a trustworthy marketplace is essential, as you'll have to connect your wallet to buy or sell NFTs. If you're using the Ethereum blockchain, you might. Where do you buy or sell NFTs? Digital-artwork NFTs are mostly sold on specialized marketplaces like Zora, Rarible, and Opensea. If you're more interested in. You can refer to 12detsad.ru's Markets section to find the list of centralized exchange the coin is listed on. Another option to buy the NFT is through a. Once you have some coins in your marketplace account, you'll need to move some over to your wallet in order to continue the process of minting your first NFT. Anyone can go out there and buy a Van Gough print, but only one person can own the original. That's exactly what it's like to buy NFT artwork. You're paying to. OpenSea is the world's first and largest web3 marketplace for NFTs and crypto collectibles. Browse, create, buy, sell, and auction NFTs using OpenSea today. Indeed OpenSea still is the best NFT marketplace, especially if you are new to NFTs. Then OpenSea should be your first platform to check out. An NFT Crypto Marketplace is essentially a cryptocurrency exchange, or in other words, a digital marketplace where traders can buy and sell NFT tokens through. One of the earliest and most popular applications for NFTs is the Ethereum-based game CryptoKitties, which allows players to buy, sell, and breed digital cats. How to Buy NFT Tokens? · A crypto wallet: this can be a hot wallet or a cold wallet. · Access to a computer and a blockchain like Ethereum (this is where most. NFTX allows you to purchase any NFT from our collection of more than vaults at the current floor price (lowest price). CoinSpot is Australia's trusted NFT marketplace where you can buy NFTs instantly using any digital currency. So by simply holding the NFT you get given other coins for free. I buy stocks, coins, tokens, nfts to SELL AND MAKE MONEY. some nfts. The key factor of ERC is its transferable nature. Users need not to select the token address every time to purchase multiple assets of the same type, eg.

Is It A Good Idea To Consolidate Loans

Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. Before deciding to consolidate debt, it's a good idea to weigh the pros and cons. On the plus side, a debt consolidation loan can potentially lower your. Consolidating your current loans could cause you to lose credit for payments made toward IDR plan forgiveness or PSLF. Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. In a way, debt consolidation can feel like a chance to reset your finances. But it's important to remember that, while debt consolidation offers short-term. Is a debt consolidation loan a good idea in your situation? When debt consolidation loans work, they can provide immense relief from credit cards and other. Consolidation could lower your monthly payments when payments begin again. However, consolidation could also extend your repayment period (how long it takes you. CU SoCal's Topaz Visa low-interest rate credit card is designed to help with debt consolidation. It offers 2% APR on balance transfers, and a low 2% transfer. Debt consolidation is a good idea when · You have debt with high (or variable) interest rates · You can qualify for a lower APR than what you're currently paying. Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. Before deciding to consolidate debt, it's a good idea to weigh the pros and cons. On the plus side, a debt consolidation loan can potentially lower your. Consolidating your current loans could cause you to lose credit for payments made toward IDR plan forgiveness or PSLF. Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. In a way, debt consolidation can feel like a chance to reset your finances. But it's important to remember that, while debt consolidation offers short-term. Is a debt consolidation loan a good idea in your situation? When debt consolidation loans work, they can provide immense relief from credit cards and other. Consolidation could lower your monthly payments when payments begin again. However, consolidation could also extend your repayment period (how long it takes you. CU SoCal's Topaz Visa low-interest rate credit card is designed to help with debt consolidation. It offers 2% APR on balance transfers, and a low 2% transfer. Debt consolidation is a good idea when · You have debt with high (or variable) interest rates · You can qualify for a lower APR than what you're currently paying.

Consolidating debt makes repayment simpler and can reduce the overall interest rate you pay. Once you qualify for a consolidation loan, you use it to pay off. Is consolidating debt more than once a good idea? · Debt consolidation can clear the deck for additional credit card debt. · Debt consolidation won't resolve. The main benefit of a consolidation loan is that all your debt is in one place, with the same rate of interest. You then have just one payment to worry about. In some cases, debt consolidation can help you secure a lower interest rate, lower your monthly payments, or pay off your debt more quickly. Regardless of these. “Debt consolidation may be a better choice if the total debt amount is manageable and you have a high credit score,” says Matthews. “Debt settlement could be a. The right personal loan can help you simplify your monthly bill paying and may save money in the long run—and that's exactly why you might choose debt. IMHO, I would stay away from debt consolidation, as with an amount of 10k, the hit your credit score will likely take won't be worth the debt. Debt consolidation can help you gain control of your finances and take you further on your journey to financial wellness. Consolidation could lower your. Debt consolidation can help you combine your debts into more manageable chunks. With fewer payments—and potentially lower interest rates—you might be able to. In fact, it may actually improve your ability to qualify. One thing that a lender will assess during the mortgage or refinancing review is your debt-to-income. If you have several major bills that need to be paid monthly, consider this the first sign that debt consolidation could be a good next step for you. Simply put, the consolidation loan is one new, larger loan that's used to pay off the other loans you currently have. One of the best ways to consolidate your. Debt consolidation can be a valuable tool in the right circumstances, but it's not a one-size-fits-all solution. By carefully weighing the pros and cons. It allows them to reduce the amount of money they pay out each month. It also reduces the amount of money they pay in interest on personal loans and credit. Debt consolidation makes the most sense when the new loan has a lower interest rate than the rate on the debts you are paying off. This helps you save money on. The biggest benefit to an unsecured debt consolidation loan is that no property is at risk. And, while the interest rate might be higher than a secured loan, it. Debt consolidation is a good idea if you feel overwhelmed by multiple debts and can simplify them into one monthly payment with a lower interest rate. It can. Debt consolidation is a good way to get on top of your payments and bills when you know your financial situation: It combines all of your debts into one. The benefits of consolidating debt. Having trouble keeping up with several high-interest loans? It might be worth rolling them into one. Debt consolidation.