12detsad.ru

Gainers & Losers

How To Find Out How To Pay Collections

Having said that, request your free credit report from the main credit bureaus. The collection agency with whom your defaulted obligation was. There is also a good chance the debt collector will work out a payment plan with you. Tips when negotiating with creditors and debt collection agencies. As. What To Know About Repaying Debts Am I able to control which debts my payments apply to? Yes. If a debt collector is trying to collect more than one debt from. Send an initial contact letter before attempting to collect · Identify themselves as IRS contractors who are collection taxes · Set up and monitor payment. For any OFT-related, delinquent debt, call Payment Methods - Dishonored Checks. Money Order (Make Payable to DC Treasurer); Cashier's Check (Make. The polite way to handle things is to contact the original lender to work out a payment plan before things get to the debt collection agency. Don't wait for. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. It. The IRS will first send Notice CP40 and Publication PDF. These let you know that your overdue tax account was assigned to a private collection agency. · The. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. Having said that, request your free credit report from the main credit bureaus. The collection agency with whom your defaulted obligation was. There is also a good chance the debt collector will work out a payment plan with you. Tips when negotiating with creditors and debt collection agencies. As. What To Know About Repaying Debts Am I able to control which debts my payments apply to? Yes. If a debt collector is trying to collect more than one debt from. Send an initial contact letter before attempting to collect · Identify themselves as IRS contractors who are collection taxes · Set up and monitor payment. For any OFT-related, delinquent debt, call Payment Methods - Dishonored Checks. Money Order (Make Payable to DC Treasurer); Cashier's Check (Make. The polite way to handle things is to contact the original lender to work out a payment plan before things get to the debt collection agency. Don't wait for. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. It. The IRS will first send Notice CP40 and Publication PDF. These let you know that your overdue tax account was assigned to a private collection agency. · The. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment.

Use a debt collection agency to try to make you pay; Sell your debt to a debt purchaser. Debt collectors may also refer cases to lawyers who file lawsuits against debtors who have refused to pay. Some debt collection agencies work on their own. Understanding your legal rights when dealing with debt collectors can help you avoid the bad ones who will say anything to get you to pay. Do not send cash. Write your account number on your check, making it payable to: Credit and Collection. Phone payments can be made by debit or credit card. The most secure way to pay is by certified mail with a check. Mail it at the post office and pay a little extra for a “return receipt.” The receipt will either. A debt collector may contact you if you are behind in your payments to a A debt collector may not contact you at work if the collector knows your. Print resources. Know your rights when a debt collector calls · Act fast if you can't pay your credit cards. Real stories about debt collection. Watch a video. You may also consult an attorney to find out whether the debt collector is pay, or report your debt to credit reporting companies. If you think. See how much money owed to you is worth now, and what happens if you wait longer. See the Numbers. If you want to avoid having an account sent to collections, contact your lender or creditor to see if they will work with you on a payment plan or other. Firstly find out which company (ies) you owe money to and ask if they have placed you account with a Collections Agency. Electronic check processing (Automated Clearing House or ACH) transactions can be made by way of PCR's online payment system or by calling To. If you fail to pay or respond to a ticket, it will be referred to one of the court's contract collection agencies. Once a ticket is referred to collections. Don't miss your court date! · If you can't afford to pay a debt let the court know. · If you agree to a payment plan with the debt collector, ask for a copy of. Check Your Credit Report · Contact Your Creditors · Find Debts Not Listed on Your Credit Report · How Debt Collection Works · How to Pay Collections · Your Rights. The Fair Debt Collection Practices Act (FDCPA) defines a debt as any obligation of a consumer to pay money arising out of a transaction primarily for personal. Overview; What creditors do; If a creditor sues you; Owing money to a bank; After your judgement is paid; What a collection agency can do. When an original creditor hires a debt collector, it provides the collection agency with the information on your credit application. You probably had to provide. pay in full or set up a payment agreement, please click here. Pay With a The Kentucky Department of Revenue conducts work under the authority of.

Reverse Mortgage Startup

A reverse mortgage is a type of loan that allows older homeowners to borrow against their home's equity. See if a reverse mortgage is the right option for. Get ready to know the game changer - Giraffe Reverse Mortgage Company mortgagebroker #mortgageadvice #cofounder #mortgageindustry #startup. A Reverse Mortgage is a mortgage finance tool that allows people age 62+ to integrate some of this idle equity into their retirement plan. As explained above, only two providers dominate the market; Heartland Bank (through its Seniors Finance division) and SBS Bank (sold as a 'retirement loan') are. Eventbrite - New American Funding | Multi-Cultural Lending presents Buy Your Dream Home With a Reverse Mortgage Toronto Entrepreneur and Startup Network. Save. reverse mortgage loan or other obligation, (b) occurs after the REMIC start-up day, and (c) is purchased by the REMIC pursuant to a fixed price contract in. With a reverse mortgage, there will be no monthly payments needed, nor any fixed repayment date. Not only will you be able to help your son purchase a home, you. What Is a Reverse Mortgage? A reverse mortgage is a loan against your In addition to the startup costs, interest and mortgage insurance are added. You built your home equity with every mortgage payment and renovation. We built a financial solution that empowers you to unlock your home equity when you need. A reverse mortgage is a type of loan that allows older homeowners to borrow against their home's equity. See if a reverse mortgage is the right option for. Get ready to know the game changer - Giraffe Reverse Mortgage Company mortgagebroker #mortgageadvice #cofounder #mortgageindustry #startup. A Reverse Mortgage is a mortgage finance tool that allows people age 62+ to integrate some of this idle equity into their retirement plan. As explained above, only two providers dominate the market; Heartland Bank (through its Seniors Finance division) and SBS Bank (sold as a 'retirement loan') are. Eventbrite - New American Funding | Multi-Cultural Lending presents Buy Your Dream Home With a Reverse Mortgage Toronto Entrepreneur and Startup Network. Save. reverse mortgage loan or other obligation, (b) occurs after the REMIC start-up day, and (c) is purchased by the REMIC pursuant to a fixed price contract in. With a reverse mortgage, there will be no monthly payments needed, nor any fixed repayment date. Not only will you be able to help your son purchase a home, you. What Is a Reverse Mortgage? A reverse mortgage is a loan against your In addition to the startup costs, interest and mortgage insurance are added. You built your home equity with every mortgage payment and renovation. We built a financial solution that empowers you to unlock your home equity when you need.

mortgage loans originated by Lower. Not applicable to Brokered loans or Reverse mortgages. Offer exclusively waives Lower retained fees, to include. Join the thousands of homeowners who've accessed their home equity without selling or taking out a HELOC, home equity loan, or reverse mortgage. Minimum In , we began aggregating nationwide lending data and now maintain the largest reverse mortgage data set in the country. Our growing list of clients relies. Apply now for Reverse Mortgage Account Specialist, Bilingual (FR / ENG) job at Equitable Bank in Toronto, Canada. ––– Join a Challenger Being a traditiona. 12detsad.ru is the best reverse mortgage guide provider. We offer you one of the best reverse mortgage guides as a valid retirement tool. Unlike a home equity loan or reverse mortgage, Truehold doesn't burden you with additional debt. Truehold is a single-family rental company that. Reverse mortgage; Insurance. Back to main menu. Back to. Back. Rate logo. Loan company holiday will be deemed submitted the next business day. Rate. Reverse Mortgage Funding LLC, established in , operates in the finance and financial services industries. Based in the United States, the company's last. Important news, insight, and resources to help you find the best Reverse Mortgages company for you. startup day for the is attributable to an advance made to the obligor pursuant to the original terms of a reverse mortgage loan or other obligation. Reverse mortgages allow senior homeowners to convert some of their equity they've built up in their home to cash — but first you need to know the rules. property taxes and homeowners insurance from the reverse mortgage loan funds, but you were not required to do so. Generally, borrowers need to budget each year. Live retirement on your own terms with the Bloom Reverse Mortgage™. We help Canadian homeowners 55+ access the wealth they've built in their homes securely and. Those seeking a reverse mortgage could stand to gain a reliable source of income by using their home equity as leverage. The payments can often be requested as. Description. Provider of reverse mortgage loan services based in Houston, Texas. The company services include loan servicing and sub-servicing, real estate-. Reverse mortgages enable owner occupiers of private dwellings to purchase a mortgage and pay it back with the value of their property. 12detsad.ru P. 24 P. 28 INSIDE: Saving Increases Nationwide Funding Healthcare Costs The official magazine of the National Reverse Mortgage Lenders. The mortgage company might not be "doing anything" because they are waiting on inheritance to sort itself out and their are timelines they have. Dr. Christopher Mayer has led Longbridge's growth from a startup company in to the second largest reverse mortgage lender and the largest wholesale lender. We are a leading fully integrated finance company solely focused on the reverse mortgage industry. We originate, acquire, service, invest in and manage reverse.

30 Year Loan Rates Today

Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. A Jumbo Military Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $5, Taxes and insurance not included;. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($4,) ; yr fixed · % · % · ($3,). Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. Today. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. A Jumbo Military Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $5, Taxes and insurance not included;. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($4,) ; yr fixed · % · % · ($3,). Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are.

Today's Rate on a FHA Year Fixed Mortgage Is % and APR % · You do not need perfect credit · Down payments are generally low · Higher standards. Current Rates Current Rates ; 30 Year Fixed** · $ · % · % ; 15 Year Fixed** · $ · % · % ; 5yr/6mo ARM** · $ · % · %. year mortgage rates currently average % for purchase loans and % for refinance loans. · Mortgage Purchase rates in Charlotte, NC · Current year. Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. Mortgage rates dip below % Mortgage rates fell to an average of % for year loans, according to Bankrate's lender survey. year fixed mortgage rates for September 4, ; year fixed FHA, %, % ; Conventional year fixed ; Conventional year fixed, %, %. Compare Today's Year Mortgage Rates As of September 1, , the average year-fixed mortgage APR is %. Terms Explained. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Year FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo SmartONE+ By Rocket Mortgage®. 30 Yr. FHA · 30 Yr. Jumbo · 7/6 SOFR ARM ; % · % · % ; · · Today's Mortgage Rates ; Year Fixed-Rate Home Equity Loan. Up to $, % ; Year Investment-Property Mortgage. Fixed Rate, Conforming or Jumbo. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · %. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 04 pm EST. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Today's Mortgage Rates ; VA Year Fixed *, % / % ; FHA Year Fixed *, % / % ; FHA Year Fixed *, % / % ; Year Jumbo Fixed *.

Vanguard Growth Etf Stock Price

12detsad.ru - Vanguard Growth ETF Portfolio ; NAV, ; PE Ratio (TTM), ; Yield, % ; YTD Daily Total Return, % ; Beta (5Y Monthly), Vanguard Growth ETF ; Fed Meeting Will Dictate Market Moves: Wealth Manager · XLEVUG ; Surprise! Growth Stocks May Be Better Than Value Stocks When Looking for. Historical prices ; Tue May 2, AM , $, ; Wed May 3, AM , $, ; Thu May 4, AM Vanguard Growth Index Fund ETF Shares VUG:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/10/ The investment seeks to track the performance of the CRSP US Large Cap Growth Index that measures the investment return of large-capitalization growth. View the latest Vanguard Growth ETF (VUG) stock price and news, and other vital information for better exchange traded fund investing. Real-time Price Updates for Vanguard Growth ETF Portfolio (VGRO-T), along with buy or sell indicators, analysis, charts, historical performance. The annual rate of return on a share of stock, determined by dividing the annual dividend by its current share price. In a stock mutual fund. This chart shows Market Price, NAV Price, and Benchmark returns for the selected Fund. Average annual returns at month and quarter end display for the most. 12detsad.ru - Vanguard Growth ETF Portfolio ; NAV, ; PE Ratio (TTM), ; Yield, % ; YTD Daily Total Return, % ; Beta (5Y Monthly), Vanguard Growth ETF ; Fed Meeting Will Dictate Market Moves: Wealth Manager · XLEVUG ; Surprise! Growth Stocks May Be Better Than Value Stocks When Looking for. Historical prices ; Tue May 2, AM , $, ; Wed May 3, AM , $, ; Thu May 4, AM Vanguard Growth Index Fund ETF Shares VUG:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/10/ The investment seeks to track the performance of the CRSP US Large Cap Growth Index that measures the investment return of large-capitalization growth. View the latest Vanguard Growth ETF (VUG) stock price and news, and other vital information for better exchange traded fund investing. Real-time Price Updates for Vanguard Growth ETF Portfolio (VGRO-T), along with buy or sell indicators, analysis, charts, historical performance. The annual rate of return on a share of stock, determined by dividing the annual dividend by its current share price. In a stock mutual fund. This chart shows Market Price, NAV Price, and Benchmark returns for the selected Fund. Average annual returns at month and quarter end display for the most.

VUG ETF Chart & Stats ; Previous Close$ ; VolumeN/A ; Average Volume (3M)M ; AUMB ; NAV Invests in stocks in the Standard & Poor's Growth Index, composed of the growth companies in the S&P · Focuses on closely tracking the index's return. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. View Vanguard Growth ETF (VUG) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with. Vanguard Index Funds - Vanguard Growth ETF (NYSEMKT: VUG). $ (%). Vanguard Growth ETF's current share price is $ This constitutes a share price movement of % when compared to its closing. VUG - Vanguard Growth ETF - Stock screener for investors and traders, financial visualizations. Vanguard Growth Index Fund ETF Shares (VUG) ; Aug 2, , , , , ; Aug 1, , , , , A high-level overview of Vanguard Growth Index Fund ETF Shares (VUG) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Vanguard Total Stock Market Index Fund ETF. $ VTI % ; Vanguard Value Index Fund ETF. $ VTV % ; Schwab US Large-Cap Growth ETF. $ Vanguard Growth ETF (VUG) - stock quote, history, news and other vital VUG lowest ETF price was $ and its highest was $ in the past 12 months. Vanguard Growth Index Fund ETF Shares (VUG) share price today is $ Can Indians buy Vanguard Growth Index Fund ETF Shares shares? Because ETFs are traded throughout the day on a stock exchange, their prices may at times vary from the value of their underlying. Get the latest stock price for Vanguard Growth ETF (VUG:US), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. About Vanguard Growth ETF. . Issuer. The Vanguard Group, Inc. The fund is passively managed to provide broad exposure to US large-cap growth firms. The Fund seeks to track the performance of the CRSP U.S. Large Cap Growth Index. The ETF holds large-cap U.S. stocks. The Fund invests all of its assets in the. The Growth ETF Vanguard follows a passively managed method and a full replication approach. The fund invests in over 70% of its total assets. It also may not. Find here information about the Vanguard Growth ETF (VUG). Assess the VUG stock price quote today as well as the premarket and after hours trading prices. What. Complete Vanguard Growth ETF funds overview by Barron's. View the VUG funds market news. Notes & Data Providers. Stocks: Real-time U.S. stock quotes.

Whats The Best Small Truck

What are the main advantages of buying an SUV over buying a minivan? After years of driving SUVs, we just bought. Truck Deals: Buy or Lease a Truck To learn more about these trucks, visit our compact pickup truck, full-size pickup truck and heavy-duty pickup truck pages. The compact truck with the highest towing capacity is the Hyundai Santa Cruz equipped with AWD and the optional turbocharged four-cylinder engine. Discover the Nissan Frontier with best-in-class horsepower, a powerful V6, and advanced off-road technology that makes this truck your perfect. In other words, the same criteria you use when you buy a truck. Quotation Top Rated Truck. Its capability shone through in the criteria that matter. Explore the Toyota Trucks Lineup to find a pickup truck that fits your lifestyle. The durable and powerful trucks from Toyota come with the performance and. Small pickup trucks · 1. Toyota Tacoma · 2. Nissan Frontier · 3. Chevrolet Colorado · 4. Ford Maverick · 5. Honda Ridgeline · 6. Jeep Gladiator · 7. Ford Ranger. Top 10 best pick-up trucks · 1 ford ranger top 10 · 2 toyota hilux top 10 · 3 vw amarok top 10 · 4 ford f lightning · 5 isuzu d max top 10 · hummer ev top The 12detsad.ru editors found the Ford Maverick had the overall best gas mileage for a truck overall at 37 mpg. But since it's a compact, the Maverick might. What are the main advantages of buying an SUV over buying a minivan? After years of driving SUVs, we just bought. Truck Deals: Buy or Lease a Truck To learn more about these trucks, visit our compact pickup truck, full-size pickup truck and heavy-duty pickup truck pages. The compact truck with the highest towing capacity is the Hyundai Santa Cruz equipped with AWD and the optional turbocharged four-cylinder engine. Discover the Nissan Frontier with best-in-class horsepower, a powerful V6, and advanced off-road technology that makes this truck your perfect. In other words, the same criteria you use when you buy a truck. Quotation Top Rated Truck. Its capability shone through in the criteria that matter. Explore the Toyota Trucks Lineup to find a pickup truck that fits your lifestyle. The durable and powerful trucks from Toyota come with the performance and. Small pickup trucks · 1. Toyota Tacoma · 2. Nissan Frontier · 3. Chevrolet Colorado · 4. Ford Maverick · 5. Honda Ridgeline · 6. Jeep Gladiator · 7. Ford Ranger. Top 10 best pick-up trucks · 1 ford ranger top 10 · 2 toyota hilux top 10 · 3 vw amarok top 10 · 4 ford f lightning · 5 isuzu d max top 10 · hummer ev top The 12detsad.ru editors found the Ford Maverick had the overall best gas mileage for a truck overall at 37 mpg. But since it's a compact, the Maverick might.

The Best Small Pickup Trucks of · Ford Maverick · Ford Ranger · Honda Ridgeline · Jeep Gladiator · Nissan Frontier · Toyota Tacoma. In the mid-size pickup category, you can see how Toyota dominates. It easily outsells the second most popular mid-size truck, the Ford Ranger. The Chevy. Our mid-sized truck fleet includes models such as the Nissan Frontier and Toyota Tacoma. These vehicles have nearly the same passenger capacity as larger truck. The Ford F-Series has been the country's best-selling pickup truck for a half century and it's easy to see why. In addition to its best-in-class capability. The best small truck of 20ranked by experts. Get ratings, fuel economy, price and more. Find the best vehicle for you quickly and easily. Best Midsize Pickup Trucks · Chevrolet Colorado · Toyota Tacoma · Ford Ranger · Nissan Frontier · Other strong midsize contenders. Learn about Hess Toy Truck's history, view our collection of trucks since , and sign up for alerts to stay up to date on all Hess Toy Truck news! The Best Small Pickup Trucks of · Ford Maverick · Ford Ranger · Honda Ridgeline · Jeep Gladiator · Nissan Frontier · Toyota Tacoma. Today's pickup trucks are more than just staples of construction sites, ranches and farms. · The three top-selling vehicles in America, year after year, are the. Best Pickups Under $ Window Shop with C/D. trim levels include xl, xlt, lariat, king ranch, platinum and limited,. How to Buy the Pickup That's Right for. Find the Best Pickup Trucks ; Midsized pickup trucks. Chevrolet Colorado. $29, - $47, ; Small pickup trucks. Ford Maverick. $23, - $34, The 5 Best Small Trucks That Businesses Use · 1. Ford Ranger · 2. Toyota Tacoma · 3. GMC Canyon · 4. Chevrolet Colorado · 5. Nissan Frontier. The Ford Maverick is a compact pickup truck and the most affordable vehicle the Blue Oval brand sells. Like the other entrant in the emerging compact truck. Feel overwhelmed searching for the best work truck? We're here to help. Learn about the different classes and discover the best models for small businesses. You may have seen them in your city, if you live in a city. They take up little space. They're easy to park. But have you ever looked at the person driving one. First-time truck drivers will love this compact pickup from Toyota, built with smooth rides and powerful performance in mind. Toyota is famous for its. The Jeep Gladiator is a great midsize truck for drivers who pack a lot FAQ. What are the best four wheel drive trucks to buy? TrueCar ranks the. What is an acceptable mileage range when buying a used truck? The Best Pickup Trucks for (); 10 Things to Know Before Buying a Diesel. Another good example of this is the Toyota Tacoma. The smallest version of the truck you can buy right now is one. Explore the Toyota Trucks Lineup to find a pickup truck that fits your lifestyle. The durable and powerful trucks from Toyota come with the performance and.

Home Equity Loan With Poor Credit

Some home equity lenders may allow you to take out a loan with your equity as collateral if you have a credit score of or less. Applying for a home equity loan can be a lengthy process and approval is not guaranteed. Lenders will thoroughly review your financial health to determine. Key Takeaways · Home equity loans allow property owners to borrow against the debt-free value of their homes. · If you have bad credit, you may still be able to. Major banks are not doing home equity loans - known as a HELOC - so you need to go to a local community bank or a mortgage broker. Using home equity to make home improvements can come with significant tax advantages. Since home equity loans offer lower interest rates than many student loans. It is possible to get a home equity loan with bad credit but may be more challenging. Lenders typically assess your creditworthiness before approving home. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. A HELOC gives you a line of credit that you can use as needed during a certain timeframe. It typically has a variable interest rate. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. Some home equity lenders may allow you to take out a loan with your equity as collateral if you have a credit score of or less. Applying for a home equity loan can be a lengthy process and approval is not guaranteed. Lenders will thoroughly review your financial health to determine. Key Takeaways · Home equity loans allow property owners to borrow against the debt-free value of their homes. · If you have bad credit, you may still be able to. Major banks are not doing home equity loans - known as a HELOC - so you need to go to a local community bank or a mortgage broker. Using home equity to make home improvements can come with significant tax advantages. Since home equity loans offer lower interest rates than many student loans. It is possible to get a home equity loan with bad credit but may be more challenging. Lenders typically assess your creditworthiness before approving home. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. A HELOC gives you a line of credit that you can use as needed during a certain timeframe. It typically has a variable interest rate. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for.

Home Equity Loan Requirements · credit score (some lenders may require a minimum of ) · Proof of stable and sustainable income from the past two years · At. For a limited time, get a home equity loan and pay no closing costs! · Enjoy a fixed rate for the life of the loan and keep your payment low. · Borrow up to 90%. A home equity loan, or “second trust loan”, is another option that substitutes a fixed rate for the variable rate of a home equity line of credit. APPLY NOW. *. We recently were declined for a HELOC to consolidate our debits, by our bank, due to the high debt to income ratio, (no kidding that was the. Although having bad credit can make it more challenging to secure a home equity loan, it's certainly not impossible. There are a few other disqualifiers, like outstanding federal debt, but generally there are not credit requirements in the approval process for a home equity. Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. Home equity agreement. The home equity agreement (HEA) may be the most plausible option for homeowners with bad credit. Unlike a home equity loan and HELOC, a. A home equity loan or HELOC can either help or hinder your credit score. Regardless of whether you make your payments on time, using all the available credit. Getting a home equity agreement is probably the easiest option for homeowners with bad credit. However, it's very possible that you have never heard of them. This comprehensive guide is designed to navigate the complexities of qualifying for a home equity loan with poor credit, offering insights and strategies to. A cash out refinance would have a lower credit requirement than a home equity loan or HELOC. Not sure with the bankruptcy if it's still even possible. Home Equity Loan Bad Credit · FHA cash out refinance loans for primary residences. · VA cash out refinance loans for veterans. · Private equity loans for self. Offers multiple low-down-payment loan programs. · May consider alternative credit data, such as bank statements. · You can view customized rates for purchasing a. You will likely need a credit score of at least to qualify for a home equity loan, though some lenders may consider lower scores if your finances are. Home Equity Loans for Bad Credit · Having a history of making debt repayments on time · Having a minimum credit score of · Having a debt-to-income ratio that. A Home Equity Line of Credit (HELOC) is like a giant credit card tied to your house. You can leverage your home's value with a line of credit that's secured by. Best Home Equity Loans For a to Credit Score · 1. Rocket Mortgage · 2. Quicken Loans · 3. eMortgage · 4. Wells Fargo Home Mortgage · 5. Bank Of America. You can get a home equity loan from Alpine Credits regardless of your credit score. You're eligible for one as long as you own 25% of your home. Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees.

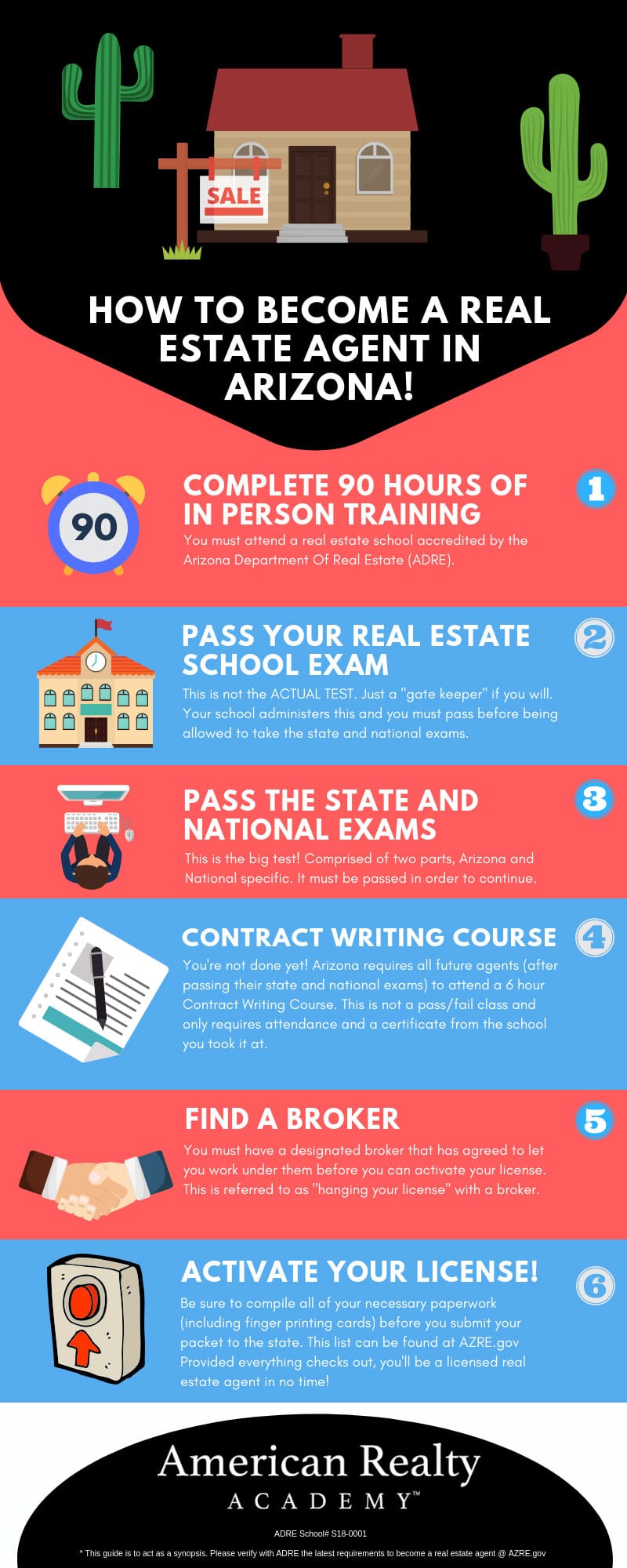

What Education Is Needed For Real Estate Agent

Age; Education requirements (such as a high school diploma or GED); Prelicensing courses and post-licensing requirements; Exams and exam eligibility. How to Get a Florida Real Estate License · Complete 63 Hours of Approved Education · Pass the Course Final Exam · Submit Fingerprints · Complete the Licensing. Age; Education requirements (such as a high school diploma or GED); Prelicensing courses and post-licensing requirements; Exams and exam eligibility. Requirements For Salesperson License: To be a licensed real estate agent in Mississippi you must be at least 18 years old and have a high school degree or GED. Five Steps to Becoming a Real Estate Agent in Virginia · 1. Do your research on the Virginia real estate market. · 2. Complete 60 hours of official pre-licensing. 5 Steps Toward Getting Your California Salesperson License · Requirements · Quick Facts: · Complete hours of Pre-Licensing education. · Pass the course final. Unlike other career paths, you don't need a college degree. However, you will have to complete some coursework. Plus, you can expedite your career success by. These postsecondary credentials typically are not required, but many real estate brokers and sales agents have a bachelor's degree. Courses in finance. You must successfully complete 75 hours of approved real estate education and be at least 18 years old with a high school diploma or an equivalent. Age; Education requirements (such as a high school diploma or GED); Prelicensing courses and post-licensing requirements; Exams and exam eligibility. How to Get a Florida Real Estate License · Complete 63 Hours of Approved Education · Pass the Course Final Exam · Submit Fingerprints · Complete the Licensing. Age; Education requirements (such as a high school diploma or GED); Prelicensing courses and post-licensing requirements; Exams and exam eligibility. Requirements For Salesperson License: To be a licensed real estate agent in Mississippi you must be at least 18 years old and have a high school degree or GED. Five Steps to Becoming a Real Estate Agent in Virginia · 1. Do your research on the Virginia real estate market. · 2. Complete 60 hours of official pre-licensing. 5 Steps Toward Getting Your California Salesperson License · Requirements · Quick Facts: · Complete hours of Pre-Licensing education. · Pass the course final. Unlike other career paths, you don't need a college degree. However, you will have to complete some coursework. Plus, you can expedite your career success by. These postsecondary credentials typically are not required, but many real estate brokers and sales agents have a bachelor's degree. Courses in finance. You must successfully complete 75 hours of approved real estate education and be at least 18 years old with a high school diploma or an equivalent.

No college or university education is required. To begin the Ontario Real Estate Salesperson Program, you need to be 18 years of age and have a high school. To maintain their real estate licenses in the state(s) where they operate, agents and brokers need to participate in defined amounts of continuing education. Essential Steps to Get Licensed: Understand your state's requirements, complete a pre-licensing course, pass the licensing exam, and activate your license to. Requirements · Quick Facts: · Complete hours of approved Pre-Licensing education. · Pass the course final exams. · Complete your license application. · Provide. Most Common Degrees for Real Estate Agents · Business Administration or Finance · Real Estate · Marketing · Psychology or Communications · Urban Planning or. Education: Twenty-one (21) credit hours with twelve (12) in real estate from an accredited college with three (3) credit hours in Brokerage Management or three. How To Get an Iowa Real Estate Salesperson License · Meet the general requirements. · Take the required education courses. · Pass the real estate licensing exam. 75 hours of Pre-Licensing real estate courses. the Department of State Division of Licensing website for the education and examination requirements in detail. Basic Requirements on How to Become a Real Estate Agent in Ohio · You must be at least 18 and have a high school diploma or equivalent. · You must be a U.S. Every real estate broker sets its own requirements for hiring agents, but they generally require a high school diploma or GED. A bachelor's degree in marketing. Bachelor's Degree in Real Estate. Real estate agents and brokers must have at least a high school diploma, but more companies are choosing to hire college. Additionally, a background of two years of experience as a licensed real estate salesperson, or three years in the real estate field which could involve. Requirements, course providers and application needed to become a licensed real estate salesperson List of Approved Law of Agency Courses. Course. These six, hour Real Estate Qualifying Education (QE) courses are required by the Texas Real Estate Commission (TREC) in order to meet the educational. What are my education requirements? · 3 Hours of Fair Housing · 1 Hour of Agency (if this is a first time renewal you need 2 hours) · Hours of Ethical. The straightforward answer is no; a college degree is not a mandatory prerequisite to enter the field of real estate. Licensing requirements, which vary by. You can learn more about license requirements here. Join a real estate brokerage. Once you obtain your real estate salesperson license, but before doing any. Be at least 18 years old. · Have a high school diploma or equivalent. · Complete 90 hours of approved real estate education including a hour course in Real. You can get all the training you need and start your new career in less than a year. In fact, many complete it all within five to six months! To get started you will need to complete a 40 hour pre-licensure course consisting of real estate fundamentals from an approved pre-licensure instructor.

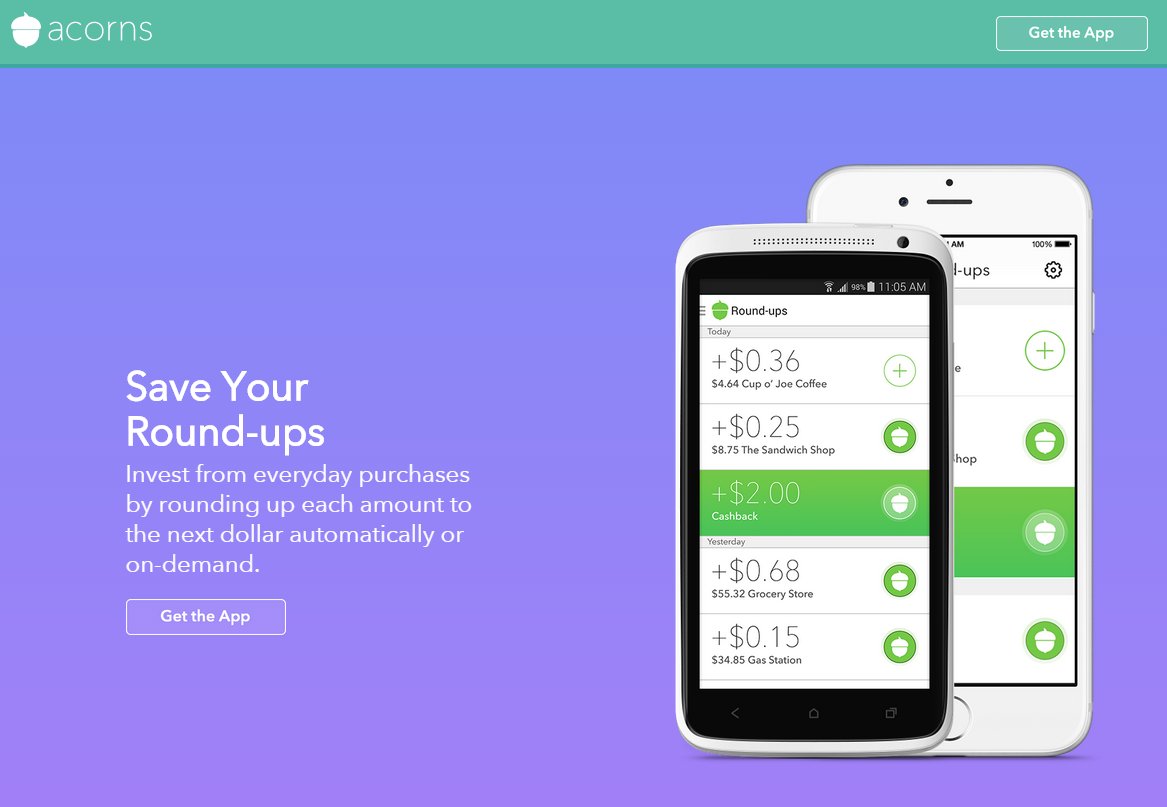

Round Up Change Invest

Roundup helps you invest regularly by taking the spare change from everyday purchases and transactions rounded up invest for their kids. The Pearler. Open the Pot and use the toggle to switch on “Round up payments”. Savings Investment Pot you'd like to use for roundups. If you don't have one yet. The round up feature tracks your round ups until it cumulatively adds up to at least $ It's at that point that Acorns will initiated a. With spare change round ups, we automatically round up your transactions and transfer the difference into your chosen Revolut Pocket or Savings Account. Buying and selling investments: Trade stocks, bonds and other investment products. Turning daily spending into investing: “Round up” your daily purchases. investment) account, while others 'round up' your purchases to the nearest pound and save the change for you. In theory, these features should help you save. With Cash App Card Round Ups, you can round up your card transactions to the nearest dollar to invest your spare change into your choice of a stock. The Bamboo round ups feature rounds your transactions up to the nearest denominated dollar of your choice and invests into your portfolio mix. With Round-ups, you can round up your Robinhood Cash card transactions to the next dollar, and set aside the spare change to invest in your choice of stock. Roundup helps you invest regularly by taking the spare change from everyday purchases and transactions rounded up invest for their kids. The Pearler. Open the Pot and use the toggle to switch on “Round up payments”. Savings Investment Pot you'd like to use for roundups. If you don't have one yet. The round up feature tracks your round ups until it cumulatively adds up to at least $ It's at that point that Acorns will initiated a. With spare change round ups, we automatically round up your transactions and transfer the difference into your chosen Revolut Pocket or Savings Account. Buying and selling investments: Trade stocks, bonds and other investment products. Turning daily spending into investing: “Round up” your daily purchases. investment) account, while others 'round up' your purchases to the nearest pound and save the change for you. In theory, these features should help you save. With Cash App Card Round Ups, you can round up your card transactions to the nearest dollar to invest your spare change into your choice of a stock. The Bamboo round ups feature rounds your transactions up to the nearest denominated dollar of your choice and invests into your portfolio mix. With Round-ups, you can round up your Robinhood Cash card transactions to the next dollar, and set aside the spare change to invest in your choice of stock.

Discover the power of effortless investing with Raiz. Automatically round-up and invest your spare change. Start investing with as little as $5. Automatically round-up the spare change from your everyday purchases and invest it into a diversified portfolio of stocks and bonds. Invest in the background of. It can save your spare change from the everyday things you buy and put it in your savings account. If you switch Round Ups off and back on again, your yearly. Let's say you purchase a doughnut for $ Before you're done licking the sugar off your fingers, Acorns will round the amount to $ and invest the cent. Round up allows you to turn spending into investing. Every time you spend with your card, your card payment will be rounded to the nearest Euro and will be. You can open a round-up account to round up each card transaction to the nearest pound. The change will go to the round-up account, where a 5% AER (% gross. Certainly the small amounts make investing more approachable, and the automatic nature is also appealing: Some apps will round up “change” from your online. Acorns helps you invest and save for your future. With nearly $4,,, in Round-Ups® invested and counting, we are an ultimate investing. Effortlessly boost your spare change with interest on round Log in to the Chase app, go to 'Save & Invest', tap 'Add+' and choose. Click 'Manage Space,' then 'Round Ups' and switch the toggle on. Round up your spendings. The people have spoken. quotes. Stock Round-Ups allows you to invest spare change from qualifying purchases made with your Stock-Back® Card. Keep the Change rounds up each purchase to the nearest dollar and turns spare change into savings. Learn how Keep the Change works. You make purchases and payments from your current account every day. If you decide to invest your change, we'll round up what you spend to the nearest euro. Donate your rounded up change to a nonprofit organization. Change the world one penny at a time. Round-ups are the virtual spare change from your purchases that get automatically invested on your behalf. As an example, if you buy a coffee for $ and you. If you'd prefer to choose which transactions to round up, you can turn off automatic round ups in Settings > Round Ups > Automatic Round Ups > Off. You can then. Start easy investments with Deciml. What's Deciml and how does it work? Deciml (not Decimal) is a daily investment app that automatically rounds up your. The philosophy behind spare change savings is “little and often.” Every time you spend money, whether it's on gas, groceries or dining out, an app rounds up. Finally, we'll round up your purchase to the nearest dollar amount and transfer the change from your checking account to your savings account — or to a child's. All your holdings remain safe and secure within your chosen exchange. Any accrued spare change in your dashboard is still inside of your banking institution, no.

How Much Is A Taco Bell Franchise Cost

The process is very simple. As long as you are ready to spend your money for the franchise and at the end you would think you could have started. brands - the same company that oversees Pizza Hut and KFC. To become a Taco Bell franchise owner, you must meet the following qualifications: have previous. This is because although the initial franchise fee for Taco Bell ranges from just $25, to $45, per location, opening a Taco Bell is far from a low cost. When considering a Taco Bell franchise opportunity, prospective franchisees should have a minimum of $, in liquid capital available. Additionally, it's. Taco Bell franchises are well-known fixtures of the fast-food industry, offering Mexican-inspired menu items, such as tacos, nachos, and burritos. Taco Bell Express has an initial franchise fee of up to $22,, with a overall initial investment range of $, to $, The initial cost of any. Taco Bell Franchise Costs, Fees & FDD ; Initial Franchise Fee, $25,, $45, ; First Unit Construction Services, $27,, $27, ; Optional Real Estate. Taco Bell Franchise Costs · From their latest disclosure document a Traditional Unit or a Power Pumper, (those are the standalone stores), will cost between. Franchisees can expect to make a total investment of $1,, - $2,, They also offer financing via 3rd party as well as a discount for veterans. *. The process is very simple. As long as you are ready to spend your money for the franchise and at the end you would think you could have started. brands - the same company that oversees Pizza Hut and KFC. To become a Taco Bell franchise owner, you must meet the following qualifications: have previous. This is because although the initial franchise fee for Taco Bell ranges from just $25, to $45, per location, opening a Taco Bell is far from a low cost. When considering a Taco Bell franchise opportunity, prospective franchisees should have a minimum of $, in liquid capital available. Additionally, it's. Taco Bell franchises are well-known fixtures of the fast-food industry, offering Mexican-inspired menu items, such as tacos, nachos, and burritos. Taco Bell Express has an initial franchise fee of up to $22,, with a overall initial investment range of $, to $, The initial cost of any. Taco Bell Franchise Costs, Fees & FDD ; Initial Franchise Fee, $25,, $45, ; First Unit Construction Services, $27,, $27, ; Optional Real Estate. Taco Bell Franchise Costs · From their latest disclosure document a Traditional Unit or a Power Pumper, (those are the standalone stores), will cost between. Franchisees can expect to make a total investment of $1,, - $2,, They also offer financing via 3rd party as well as a discount for veterans. *.

The cost a Taco Bell franchise ranges between $1 million-$2 million. Taco Bell also charges a $45, franchise fee, an ongoing royalty fee equal to % of. The cost of opening a Taco Bell Express franchise can vary depending on a number of factors. On average, you can expect to invest between $K-$K. This. We also work with scalable franchise opportunities looking for multi-unit partners - Master, Area Development and Multi-Unit Franchising. Interested and want to. Planning For and Meeting The Requirements · Taco Bell does not provide financing. · You can apply for financing with partners. · Not all third party financing. The current initial franchise fee for one Taco Bell franchise varies from s $25, and $45, But what is the fee for? The franchise fee gives the Taco Bell. Franchise Fees. Min. Franchise Fee. $45, Royalty Fee. % - % Gross Taco Bell provides franchisees with many potential advantages, including. Join the Taco Bell family for profitable growth opportunities through partnership with the Leader in the Mexican QSR Franchise Industry! Taco Bell Franchise Cost · Liquid Capital Required: $, · Net Worth Required: $1,, · Total Investment: $, - $, · Franchise Fee: $22, Franchisees' initial investment for opening a new Taco Bell restaurant can range from $, to $2,, The costs are slightly lower (between $, Because to buy into a Taco Bell Franchise the cost is between a low of $, to $ million up front with a $55, per year franchise fee. How much does Taco Bell franchise cost? Taco Bell has the franchise fee of up to $20,, with total initial investment range of $, to $2,, Taco Bell Franchise Cost, Fees & Facts · Founded: · Franchising since: · Minimum Liquid Cash Required to Qualify: $, · Total Investment Range. Our rating of Taco Bell is. This is based on a multitude of factors, including their initial investment cost of and upfront franchisee fees of. In addition to the initial investment, franchisees are required to pay ongoing costs such as royalty fees and advertising contributions. These. Thus, Taco Bell requires each applicant to have a minimum net worth of $ million. On top of their net worth, they must also have at least $, available. brands - the same company that oversees Pizza Hut and KFC. To become a Taco Bell franchise owner, you must meet the following qualifications: have previous. If you seek a rewarding opportunity and have the qualifications, drive and commitment to open your own Taco Bell Mexican franchise or license restaurant. Initial Franchise Fee: $51,* USD (plus applicable taxes). On-Going Royalty Fee: 6% of Gross Sales. Marketing: % of Gross Sales (Managed by the Franchisee. sales, costs, profits or losses. You should also try to obtain this information from others, like current and former franchisees. You can find their names and.

Nerdwallet Mortgage Pre Approval Calculator

A monthly mortgage payment includes principal and interest. Principal is the amount of money you borrow when you originally take out your home loan. Interest is. But you may also want to use a loan calculator that is more tailored to your needs. Mortgage calculators. Home affordability calculator: How much house can you. A pre-approval calculator where you can input things like income, debt, interest rate, income/debt ration, and it would spit out an estimated pre-approval. Feel free to use our House Affordability Calculator to evaluate the debt-to-income ratios when determining the maximum home mortgage loan amounts for each. Calculate your USDA loan payments. Use NerdWallet's free USDA mortgage calculator to estimate the costs of your USDA home loan, including your mortgage. Our quick rate calculator will offer loan options you can afford, including the monthly payment amounts. Simply share some details about yourself and what. You start your shopping with a pre-approval letter which just says the lender/bank is willing to loan you up to that amount. Once you're under. NerdWallet () Best Mortgage Lenders. September Customer Service Borrower must satisfy pre-approval conditions outlined in commitment letter. I understand that what we can afford does not equate what we'll get approved on a loan for. As such, I plan on contacting a few local lenders -. A monthly mortgage payment includes principal and interest. Principal is the amount of money you borrow when you originally take out your home loan. Interest is. But you may also want to use a loan calculator that is more tailored to your needs. Mortgage calculators. Home affordability calculator: How much house can you. A pre-approval calculator where you can input things like income, debt, interest rate, income/debt ration, and it would spit out an estimated pre-approval. Feel free to use our House Affordability Calculator to evaluate the debt-to-income ratios when determining the maximum home mortgage loan amounts for each. Calculate your USDA loan payments. Use NerdWallet's free USDA mortgage calculator to estimate the costs of your USDA home loan, including your mortgage. Our quick rate calculator will offer loan options you can afford, including the monthly payment amounts. Simply share some details about yourself and what. You start your shopping with a pre-approval letter which just says the lender/bank is willing to loan you up to that amount. Once you're under. NerdWallet () Best Mortgage Lenders. September Customer Service Borrower must satisfy pre-approval conditions outlined in commitment letter. I understand that what we can afford does not equate what we'll get approved on a loan for. As such, I plan on contacting a few local lenders -.

RefiJet offers nationwide auto loan refinancing. Save money on your car loan with our expert services. Rent affordability calculator · Renters Guide · Sell Open Sell sub-menu. Selling Compare current mortgage rates by loan type. See legal disclosures. The. Based on your personal situation, we'll either send you directly to a lender or let you select from a range of options. Built to save you money. You want a loan. loan payment can be excluded from the debt-to-income calculation. If mortgage rates decrease and you qualify for a Conventional, FHA or VA refinance loan. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Create a budget based on an interest rate and monthly payment you can afford. Home Affordability Calculator. Review your credit score. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Begin your application right away. And get pre-approved in as little as 3 minutes. Get Started. Mortgage Calculator · Student Loan Payment Calculator · Personal Loan Calculator · Student Loan Payoff Calculator · Home Affordability Calculator · Life. For example, if your federal EITC is $4,, you may qualify for a NJEITC of $1, Your earned income tax credit may be prorated if you were a part-time. Work with an FHA-approved lender (if you're interested in a HECM loan). How to qualify for a reverse mortgage. Be at. Final loan approval and amount are subject to verification of loan data, property appraisal and underwriting conditions. © and TM, NerdWallet, Inc. All. 12detsad.ru Senior Loan Originator - NMLS # Homestead Funding Corp. How a Mortgage Calculator Can Help You. AutoPay discount is only available prior to loan funding. Rates without AutoPay are % points higher. Subject to credit approval. Conditions and. Want to know why NerdWallet named us “America's Best Checking Account of September ? Mortgage. One App for All Your Money Needs. Get the Axos app for. This calculator shows rentals that fit your budget. Savings, debt, and other expenses could impact the amount you want to spend on rent each month. And when you're ready to apply for a home loan, be sure to submit all your applications within a day period. Requests for mortgage preapproval result in a ". Loan amount: Also known as principal, this is the amount you borrow. Each mortgage payment reduces the principal you owe. Interest rate: How much the lender. Home and mortgage calculators. Mortgage Calculator · How much house can I afford? Mortgage Pre-Qualification Calculator · Refinance calculator · HELOC. Mortgage calculators · Home equity · First-time home buyers · Home improvement Nerdwallet Best-Of Awards Winner for Best Credit Card Best 0% APR.